There’s been a lot of movement in the skin gambling market as of the last few weeks including surmounting pressure around the ongoing loot box debate.

First, Valve issued a cease-and-desist order to popular third-party trading platform OPSkins, sending a tremor through the community . Less than two weeks later, the Dutch Gaming Authority forced Valve to restrict trading from within the Steam marketplace for all users in the Netherlands, until further notice. The extremely turbulent market presents some serious implications for both Valve and its customers; has the rampant skin market gotten too large for them to control? Let’s discuss further in this week’s ESI Gambling Report.

Skin gambling & loot boxes

The antiquity of skin gambling is a long-winded one, and there’s enough information on the subject to keep anyone that is absorbed by it occupied for quite some time, so we won’t bore you with a history lesson. We will tell you however, that the market is colossal, and while that exact figure is incredibly difficult to pinpoint due to its highly unregulated state, it’s projected that skin gambling and loot boxes will achieve an expenditure of $50 billion (£35.265 billion) by 2022, according to Juniper Research. While we’re skeptical of this figure, even a fragment of it would still correspond to a sizable amount.

To contrary belief, gambling using an in-game item as currency is not illegal – depending on which country you hail from that is. In the United Kingdom for example, operators are free to utilize skins as a form of currency providing they have acquired a license from the commission. Other countries such as the Netherlands, have taken a much firmer stance on the matter as we saw earlier this week; the Dutch Gaming Authority, also known as the Kansspelautoriteit, prohibits both ‘internet esports betting’ and ‘internet skin betting’ nor do they offer licenses to do so. For a more comprehensive outlining on skin gambling legality, you can refer here for further information.

Skin gambling and loot boxes having been targeted as an unwanted development can easily be explained; its most pressing implication is the accessibility of minors to wager these skins. The Gambling Commission spotlighted that a reported 11% of 11-16 year olds in the UK had gambled with skins in a 2017 study – a percentage accounting for approximately 500,000 minors who had engaged in underage betting. The skin gambling market was birthed in what many consider to be Valve’s masterstroke, the Steam API; the API (application programming interface) enabled platforms to integrate the Steam marketplace trading technology directly onto their site. This led to a rapid blossoming of the skin market as essentially anyone could become an operator and the only prerequisite to place a skin wager was a Steam account. All the while, Valve has reaped the rewards as they receive a cut from transactions taking place on the market as high as 15%. However, with increasing pressure from nations and government to address loot boxes and underage gambling, Valve is now finding themselves in a tough spot.

Walls closing in on Valve

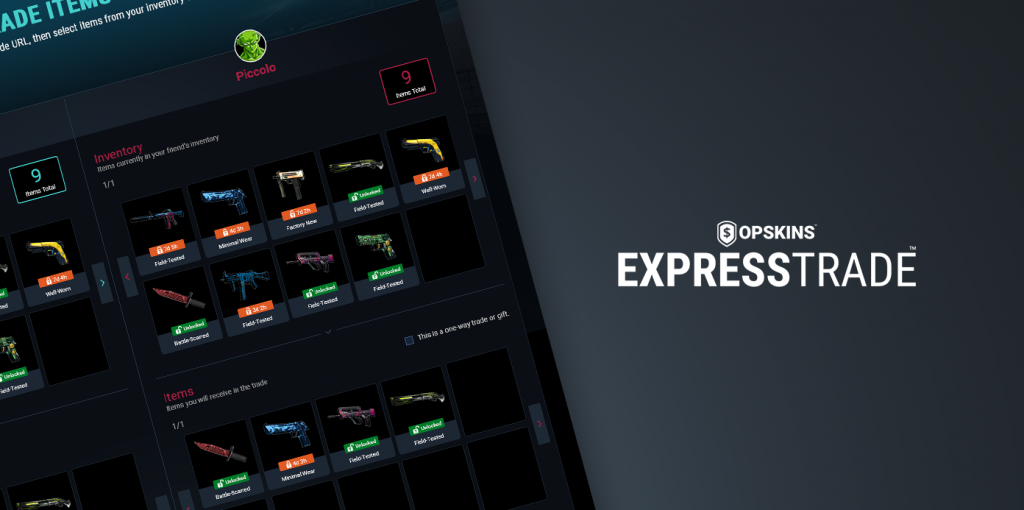

The popular CS:GO buy, sell, trade platform OPSkins being delivered a cease-and-desist order seemingly out of the blue was startling for players, but it shouldn’t have come to a surprise. OPSkins’ downfall followed the launch of ExpressTrade, a trading service which bypassed the seven day trade lock of skins on the Steam marketplace as well as the fee associated with it, making it free for users to trade skins.

The third-party trading platform was cashing in on Valve’s intellectual property and their motive seemed clear as the dismemberment of OPSkins would ultimately drive users back to the marketplace where they could collect on transactions. As OPSkins went offline yesterday (June 21st), a figure was released detailing the value of items lost to be $1,966,510 (£1,483,447) – that’s nearly $2 million wiped clean from the skins economy.

And while that number may seem alarming, it’s hardly a drop in the bucket comparatively to the estimated total value of CS:GO skins, which according to CSGO Backpack is $248,751,028 (£187,617,975).

This presents another issue for Valve as they were forced to lock trading for users in the Netherlands earlier this week due to the Dutch Gaming Authority ruling – stripping skins in Dutch inventories of their value. The total value of those skins is undetermined at this time, but the fact remains if Valve is unable to find middle ground within this dispute Dutch users will take a financial hit in which its strength will be determined by each individual’s investment in skins. It’s safe to imagine users losing potentially tens of thousands of dollars in skins is going to result in a major clash.

Other nations aren’t far behind the Netherlands either – Germany, Sweden and Belgium have all looked into potential loot box and skin gambling governing, although have not taken the forceful precedent the Dutch have on the matter. Even the United States chimed in back in 2016, delivering notices to Valve to act upon gambling sites utilizing the Steam API and prompting the ‘Valve crackdown’.

Future of skin gambling

So where does Valve go from here?

It appears the company has their backs against the wall as the realisation of unregulated skin gambling being an unsustainable business plan is surfacing among the latest events. Disabling trading across the board wouldn’t seem to be a feasible option as the aforementioned nearly $249m in skins would essentially evaporate from the pockets of their customers. Is it within Valve’s power to wipe this economy clean? Possibly, but it surely wouldn’t go over well with their clientele. Considering a potential payout of this amount as a technique to wipe their hands clean prompts the question of who is going to front that money. As much as everyone wants to shift blame on Valve, they didn’t assign value to the skins, rather the community and market did. Furthermore, Valve has long maintained the stance that virtual items will always have a real monetary value, and thus they do not control the market which has developed as a result of their product. As the clock seems to be ticking down for Valve to begin implementing some serious changes towards the market operations, there still remains a large breach of what an end-all solution might look like.

Do skins have a place in a regulated betting market? Esports icon Paul ‘Redeye’ Chaloner thinks so. Redeye, who is an ambassador for Luckbox, shed some light on how skins could fit into a licensed and regulated system – although, he admitted it wouldn’t look anything like it does today. Just as the US is undergoing growing pains in its transition from shadowy black market to licenses and regulation following the repeal of PASPA, the skin market would weather like amounts of energy, time and money to achieve this.

A licensed skin betting platform may be a plausible option for Valve to get a handle on the unbridled skin market, but that road will require a lot of paving before it becomes a reality. For now, Valve will have to continue to fortify the skin gambling market they’ve fostered – however, we’re unsure how much longer the market can withstand before collapsing entirely permitting there aren’t any pivotal shifts.