Ranging from tournament organisers to esports organisations, October saw a variety of entities within the esport space announce significant investments and acquisitions.

As such, Esports Insider has compiled a list of last month’s key investment stories. To read more about a story below, click the link in the corresponding title.

This month’s investment report is in partnership with ESI London, Esports Insider’s ultimate industry showcase which is set to take place on November 8th-9th.

With regards to investment news, the business conference features panels such as the ‘2020/21 Esports Investment Recap’ as well as a look back at previous winners of ESI’s investment pitch competition, The Clutch.

Some of the entities speaking at the event include EXCEL ESPORTS, Fnatic, Guild Esports, McLaren, Alpine F1, BLAST, Team Liquid, ASOS, Betway and more.

Tickets for the event are still available here.

Spotlighted Story:

FaZe Clan goes public, to be listed on NASDAQ

North American esports organisation FaZe Clan has announced details of a merger with B.Riley Principal 150 Merger Corp (BRPM).

If the merger is successful, the company will become a publicly listed company on NASDAQ in the following months. The transaction implies the valuation of the company is in excess of $1B (~£726.2m), thus making FaZe the first ‘esports unicorn’ — or a company worth more than a billion dollars.

Riot Games acquires Kanga to create better fan experiences

Game publisher Riot Games announced the acquisition of media technology startup Kanga.

Kanga will join Riot’s Global Digital Esports group where it will focus on developing digital fandom features and experiences. Financial details of the acquisition have not been revealed.

100 Thieves acquires peripherals brand Higround

North American esports organisation 100 Thieves has announced the acquisition of gaming keyboard brand Higround.

Alongside the announcement, the two companies also revealed the release of a 100 Thieves themed Higround keyboard, the first in a series of collaborations. Details regarding financial figures of the purchase have not been disclosed.

BITKRAFT Ventures launches $75m gaming and esports-focused token fund

BITKRAFT Ventures, a global early and mid-stage investment platform for esports and gaming, has launched a $75m (~£55m) Token Fund for blockchain investments within the sectors.

According to the release, the fund will focus on investments that impact the gaming and digital entertainment ecosystems.

MMA fighter Marvin Vettori invests in QLASH

European esports organisation QLASH has announced Italian MMA fighter Marvin Vettori as its latest investor.

According to the release, Vettori joins the organisation on account of his ‘great relationship with the club and its administration’. Financial figures of the investment have not been revealed.

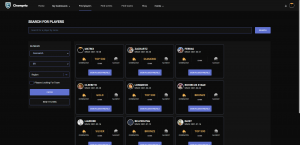

Esports startup Champria raises $1m

Esports technology startup Champria has announced a $1m pre-seed round led by Kickstart Fund, a venture capital fund from the United States.

Aside from Kickstart Fund, the round also included the New Mexico Arrowhead Innovation Fund, Gokul Rajaram, David Carrico, and a number of other angel investors. Founded in 2020, Champria focuses on a set of technologies to help players find teams and improve their skills.

Axcel agrees to sell SteelSeries to GN Store Nord for DKK 8bn

Danish private equity firm Axcel has agreed to sell its gaming hardware company SteelSeries to GN Store Nord, a manufacturer of hearing aids and headsets.

GN Store Nord will pay 8bn Danish Krone (~£915.18m) for SteelSeries, with the acquisition expected to close at the beginning of 2022. As of this writing, the transaction is still subject to approval.

The deal will see ESE acquire 100 per cent of Frenzy for a price of CAD $1,242,500 (~£726.2k) in cash and 656,606 common shares of the company. Moreover, an extra CAD $1,242,500 will be payable over six months.

Coda Payments announces acquisition of BAASH

Singaporean payment provider Coda Payments has acquired mobile esports platform BAASH from CAPSL Entertainment.

As a result, Coda Payments will expand its existing portfolio of gaming products. This includes the provider’s esports tournament platform Codashop Global Series (CGS). Financial details of the acquisition were not disclosed