The esports industry needs to grab and secure its share of advertisers’ budgets before the next recession kicks in, writes David Fenlon in this guest piece.

In lockdown, esports has become the darling of the entertainment world. Mainstream media outlets’ tone has changed from labelling these activities with pariah status to lauding competitive video gaming as a heroic tool battling loneliness in lockdown conditions. Gone are the articles about “the dangers of video gaming addiction” and the commercial problems of the esports world. It also provides live content which the same media channels fill their now empty programming schedule due to the lack of professional sport. Frankly, esports have a monopoly on all live competitive events occurring now.

However, the underlying issues with esports haven’t gone away. A new and enlarged captive audience does not sort the lack of mechanisms to monetise said audience. Nor does it guarantee that this audience will remain once other options become available. The lockdown will end at some point in the coming months, so, the esports industry has a limited window to grab viewers and to find ways to maintain engagement with this audience once lockdown is over.

Viewership on the march

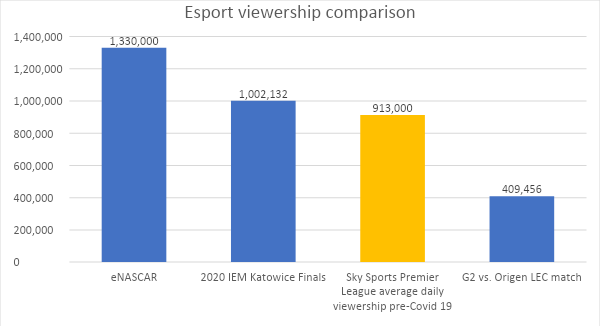

There is no doubt that esports has seen a dramatic rise in audience numbers. This has been experienced across the spectrum, from well-established events to up-and-coming esports. For instance, the IEM Katowice Final 2020 broke records with peak concurrent viewership of 1,002,132. The eNASCAR series, which has been aired on mainstream TV, recorded a viewership of 1.33M across FOX and FS1.

The recent match on weekend 2 of the LEC Spring Split between G2 and Origen received 409,456 viewers, double their usual audience. To put this in perspective, Sky Sports Premier League got an average daily audience of 913,000 in mid-January this year, prior to the impact of Coronavirus. These figures can be seen in the chart below:

Converting demand into profit

Whilst this is great news for esports organisations as such a large degree of mainstream coverage is likely to further legitimise the medium, this does not necessarily mean a proportional jump in revenue for the industry. Firstly, there are very few media groups that pay for broadcasting rights of tournaments. Nor has the industry aligned itself to maximise the opportunity to introduce lucrative broadcasting rights contracts as a consequence of this rise in viewership. Secondly, the industry’s relationship with non-endemic brands, where most potential sponsorship money lies, is mixed and underdeveloped. Significant progress has been made in this area in the last few years, with industry sponsorship alleged to be in the hundreds of millions of dollars.

However, this fades into insignificance when compared to broadcasting, advertising and sponsorship deals in the traditional sports industry. For point of comparison, the English Premier League alone makes c.£4.2bn in non-matchday income. Even EPL revenue is small in comparison to broadcasting and sponsorship deals present in American sports. The risk for esports entities is that they do not have the clout with the decision-makers at brands to tap into idle marketing budgets that are allocated to professional sports teams.

Thirdly, there is very little alternative to sponsorship or broadcasting revenue. To diversify risk esports entities may have to think of other ways to monetise the audience they are cultivating. As a point of comparison, Disney + who target a similar segment of the market has exceeded 50m subscribers in the 5 months since launch. This shows how much Coronavirus has impacted the demand for digital entertainment given their initial target was to gain 60m – 90m subscribers by 2024. There might be a drop off in subscriptions after lockdown is lifted, but for the sake of £5.99 per month for premium content, any drop off is likely to be muted.

Interestingly, Disney + has managed to convince the same audience segments that esports are targeting to pay for content, something the latter has had little success with. The is no real equivalent model of sustained revenue from new members of the esports community. Benefits being reaped, such as raised prices for keys to CS:GO boxes and an increase in esports gambling, is all a bit transactional, and not laying down the foundations for future growth. Simply put, esports entities have not developed a direct relationship with their audience to the point where they can mitigate their dependency on brand sponsorship and advertising revenue.

The inevitable fall in marketing budgets

Evidence of sustained interest in esports, and plans to facilitate this, are what many brands will be watching carefully for prior to investing in the industry. There has been an initial scramble to have some presence in esports by brands who have been exposed by the shutdown of live sport and other entertainment mediums such as cinema. Many more are still on the side-lines waiting to see how this plays out.

The woes of live sport are likely to continue well into July/August and maybe till the end of the year as confusion over contracts, and whether to play games in empty stadiums, will endure. But there is an endpoint to this artificial advantage that esports currently has. And with a recession upon us, the main route of growth for esports is through grabbing brands’ marketing budgets ahead of traditional sports and advertising.

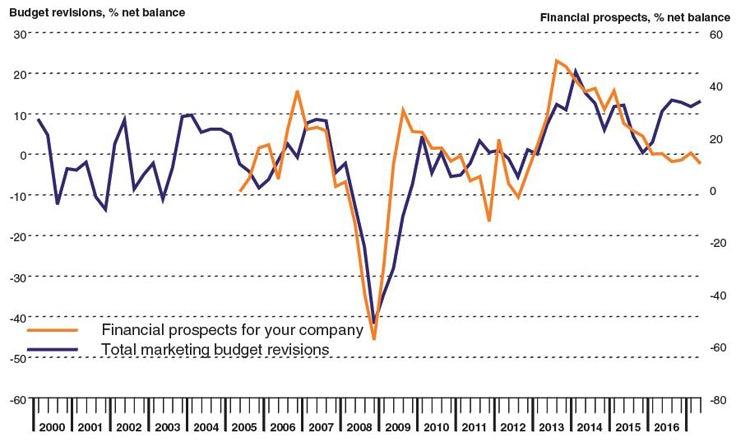

Brand marketing budgets, the key dependency on which esports fortunes currently rise and fall, are likely to be drastically cut if the last recession is anything to go by. In 2008 – 2009 marketing budgets fell by 40%. They closely mirrored the financial prospects for companies as shown in the graph below:

The size of this recession is likely to be large. For instance, with the UK economy expected to have contracted by 35% by June marketing budgets will likely follow suit. This does not make for pretty reading if you are an esports company looking for sponsorship or advertising revenue. It is also a very large problem for an industry trying to secure media rights contracts in 2020, as less advertising budgets has a knock-on effect on media rights budgets.

The only way that the esports industry will derive growth from this is being able to successfully divert money that would otherwise have gone on sports to esports events. There is a real chance of being able to do this but there needs to be a clear strategy from esports entities to sustain the new level of engagement they have now with their audiences and to grow it.

Cementing engagement with fans

There needs to be some sort of hook to keep their audiences watching and to develop this relationship. This can vary from free tickets to go to live events planned for the end of this year/beginning of next, to set up of grassroots competitions, to direct engagement by give-aways of team merchandise. Some direct two-way communication between audience and esports entity needs to occur to heighten engagement. Else esports entities will see: a drastic drop off in audience when the lockdown is lifted; a continued pattern of distributing free content for very little from their audience in response; and a missed opportunity in convincing brands to spend their advertising budgets on esports.

The recent rise in awareness of esports has gone a long way to legitimise the industry in the eyes of the potential growth drivers of the industry i.e. non-endemic brands and their marketing teams. Whether it becomes a mainstream entertainment staple is dependent upon proving to non-endemic brands, and mainstream media, that the rise in audience numbers will continue to grow after lockdown. It is also crucial to demonstrate ways of esports entities monetising this audience beyond advertising. This will not only convince brands to get involved but will also lessen the dependency on advertising revenue in a poor economic outlook.

Some of the professional teams have cleverly started to pivot to becoming lifestyle brands rather than simply esports teams, trying to monetise their direct relationship with their audience. Accelerating initiatives like these to stop new fans from simply “switching-off” what was so easy to switch on before will have a massive impact upon the industry. Actions of the next two months will determine the outcomes of the next 24 months of the esports industry. A big opportunity, but very little time to capitalise on it.