A recent report by esports viewership data platform Esports Charts has found that the total number of hours watched for esports tournaments has grown roughly three times since 2017.

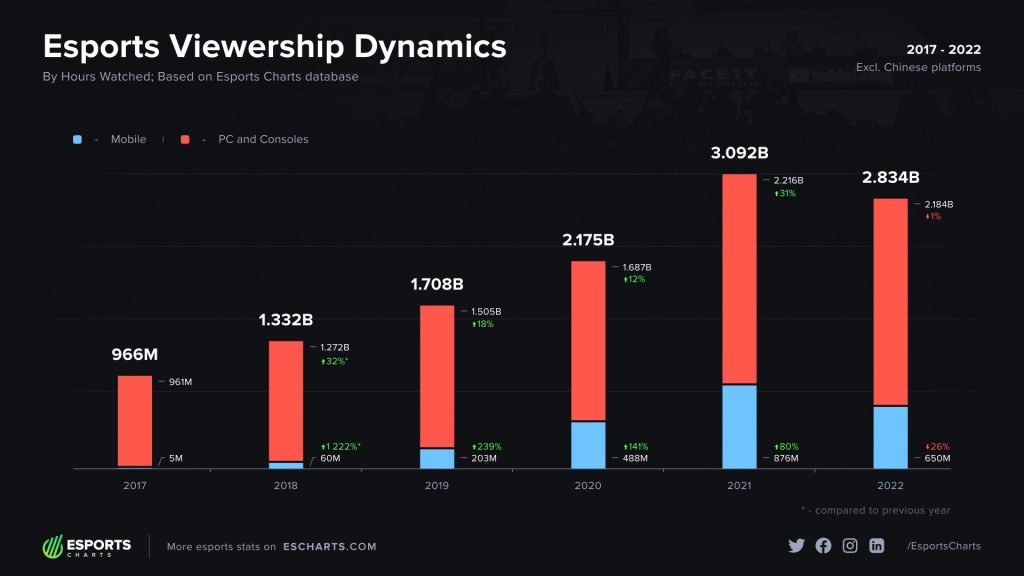

The report, which mostly compares viewership between 2017 and 2022, found Hours Watched had increased from 966m hours in 2017 to 2.8bn hours in 2022 (excluding Chinese viewership) — a rouhgly 300% jump.

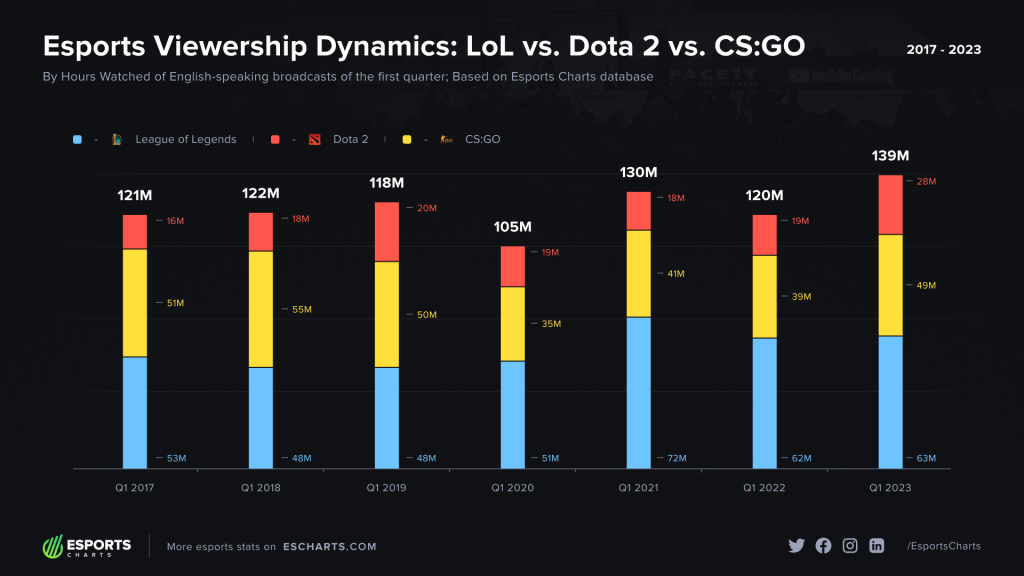

Esports Charts importantly does not track viewership on streaming platforms in China — the largest esports market in the world — due to the difficulty in measuring that data. This will have an outsized impact on data from esports titles with large Chinese followings, such as League of Legends.

Esports hours watched nonetheless saw steady double digit growth from 2017 until 2021, when they peaked at 3.1bn hours, before experiencing a 6% drop to 2.8bn in 2022.

The Esports Charts report cited India’s ban on leading esports titles as one contributing factor in the year-on-year decline — though that decline may in part soon reverse with the likes of Battlegrounds Mobile India recently being unbanned.

However, despite the largely steady increase in esports viewership, the sources of this growth have not been uniform and have changed over time.

Mobile esports viewership has been the main driver of continued growth, going from representing 0.5% of total hours watched in 2017 to a massive 28% when viewership peaked in 2021.

This mobile esports growth has mostly taken place outside the West, particularly in Southeast Asia, where mobile esports is much more popular than PC-based titles. In Indonesia, for example, the report found that the mobile esports audience had grown 5-6 times in the last three years — largely thanks to Mobile Legends: Bang Bang.

The titles driving viewership growth have also naturally changed, the report’s findings indicated. English-language broadcasts of the so-called ‘big three’ esports titles — League of Legends, CS:GO and Dota 2 — grew their collective share of hours watched by only 13%, based on a comparison of Q1 viewership between 2017-2023. Non-English language broadcasts also likely played a big role in pushing figures up.

“When it comes to the viewership growth of esports, it is important to understand that the growth of the entire industry is directly related to the growth of its individual segments — and not always those that form the basis of the industry,” the report’s conclusion reads.

“The largest and worldwide popular games may not grow at the highest rates, while sharp jumps in popularity are made by local games and language segments.”