Comparing esports to football or basketball is advantageous for the esports industry in some cases, but it usually does not tell the whole story. The companies that perform well in traditional sports do not always see success in esports, and there are just a few cases of esports brands entering traditional sports — like EVOS, an esports brand that started a basketball team.

There are some companies that have seen success in both, and can offer a unique perspective on the growth of esports.

Blinkfire Analytics, a company specialising in sponsorship intelligence and marketing analytics in sports, esports, media and entertainment industries, is one of them. Founded in 2013, Blinkfire uses artificial intelligence and machine learning and other technologies to provide insights into sponsorship metrics for a large number of sports and esports clients.

The company works with big names in sports, such as Real Madrid, FC Bayern and MotoGP, as well as notable esports brands like the FaZe Clan, Misfits Gaming Group, ESL Gaming and Giants Gaming.

Esports Insider spoke to Alexis Prousis, VP of Marketing, and Johnny Kutnowski, VP of Product at Blinkfire to learn more about what esports can learn from traditional sports — and vice versa.

Industry trends

To start things off, we wanted to know: what were the top three trends that Blinkfire saw in 2022 across its esports vertical?

The first one is, perhaps unsurprisingly, a domination of short-form videos on platforms such as Instagram, TikTok and YouTube. Even though streams are long, 2022 saw an abundance of clips and short videos that generated millions of impressions for esports brands.

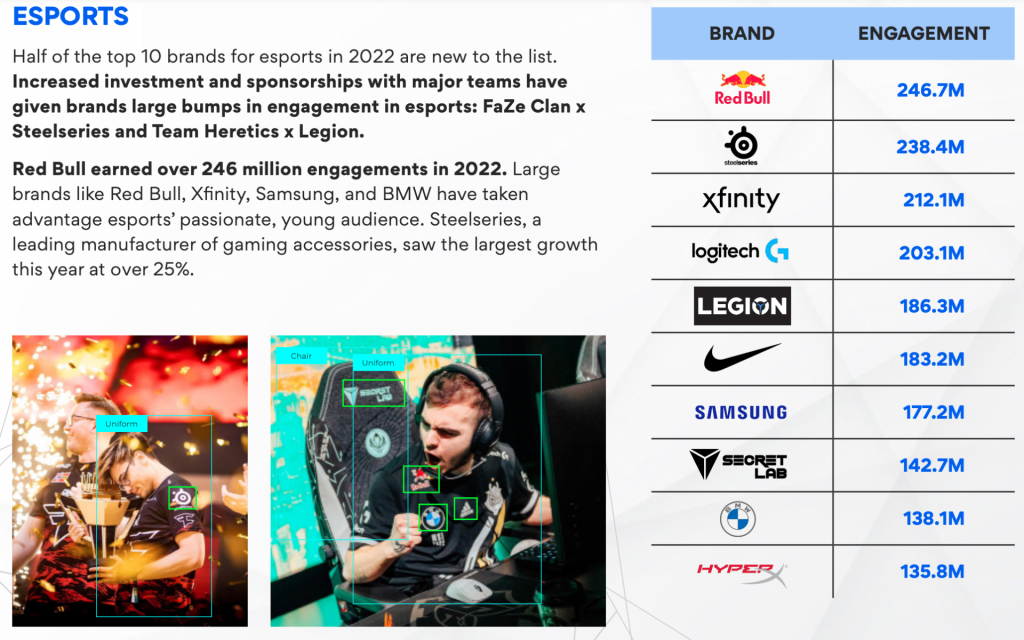

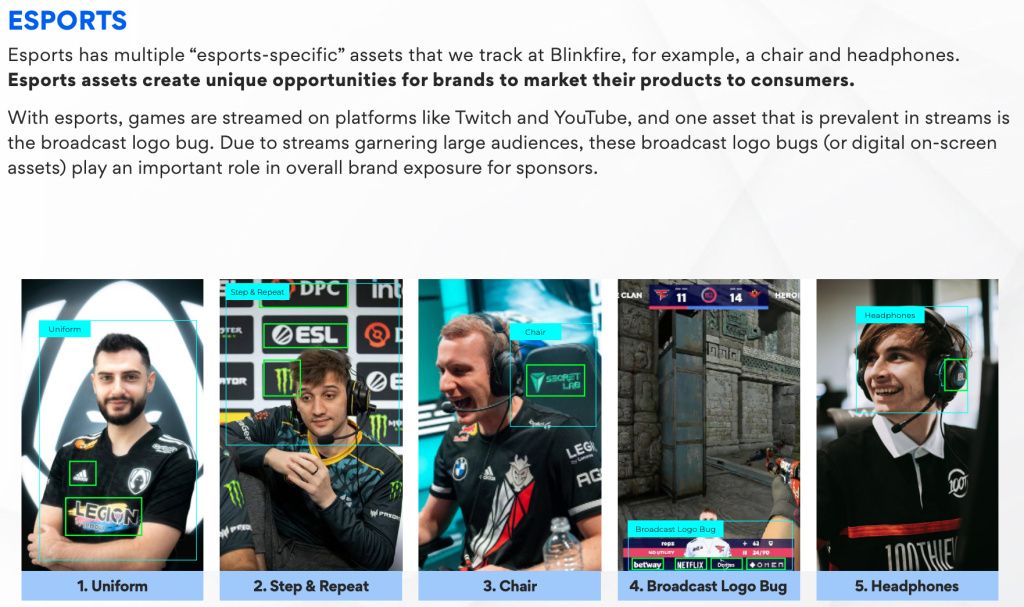

The second major trend is an increase in partnerships and sponsorships. Blinkfire’s data showed that more assets are being sponsored than previous years. The most-used assets include headphones, chairs and jerseys.

The third trend is the inclusion of more content series or ‘scenes’, as Blinkfire puts it. These include pre-made posts such as birthday announcements for esports players, game preview posts on social media and similar. Posts like this are getting more sponsors, and, as Prousis puts it, there is a definitive shift in the tendency to sponsor this kind of content for esports brands.

Kutnowski added that esports brands, due to their digital nature, are much more likely to jump on board with new trends, including viral memes and content, and used the example of Fnatic signing Rekkles for the second time.

“Fnatic signing Rekkles again this year is a ‘coming back’ story of sorts. Rekkles is also a serious figure in League of Legends, and [Fnatic] brought him back by using old clips, and they monetised old content while also creating new posts [with] him. They are doubling down on that and it really creates a snowball effect of sorts.”

Esports trends

Blinkfire, having started as a sports data company, is in a unique position to directly compare traditional sport and esports. Kutnowski said that Blinkfire is continuously developing its product by taking the lessons learned from sports, and then making those into tools and products that esports organisations can then utilise. But the company also applies lessons learned in esports to traditional sports, to help brands reach a broader audience.

“It’s funny because it’s football teams,” Kutnowski said. “It’s Champions League winners, and now they are on Twitch because they are imitating what some esports organisations are doing.”

Sports brands now take content formats familiar to esports, such as social posts that describe matchups, live streams, short video interviews, behind the scenes content, birthday posts and more.

An interesting difference between how esports and sports brands operate is the inventory they are trying to sell to consumers. Blinkfire’s Inventory Manager allows the company to see some interesting data from both sides. Basically, traditional sports companies rely on physical activations and assets, like in-venue billboards or beverage partnerships.

For sports brands up until 2020, digital activations were mostly a bonus following the ‘real’, physical activations, but things are changing there, too. In esports, there is not as much inventory, nor as many physical assets, that companies can sell. Esports brands do have their jerseys and training centres and headquarters, but that is not remotely close to having a dedicated stadium for 50,000 people. Kutnowski said:

“So then you have to focus on the social, and that’s where we are seeing esports organisations create digital products constantly. For example — birthday posts. Companies are seeing that a particular kind of post gets perhaps three times the engagement of an average post, and then they package all posts of that type as something they can sell to a partner. These activations come very cheap and create high engagement, and in the end you have a product you can sell.”

Endemic versus non-endemic

If you are an esports fan, you are familiar with the ‘endemic’ brands; the gaming peripheral companies, or perhaps energy drinks or gaming chair brands. In traditional sports, there is no such thing. Kutnowski said that things like that do not matter in traditional sports, with most NFL or NHL teams having some partners that are not at all connected to their sports — but we, as fans and customers, understand that.

Kutnowski said that esports can learn from this. For him, there are no brands that are not a good fit for esports, aside from those that are intended for mature audiences. But brands are often having second thoughts about esports because of the gatekeeping that sometimes takes place in the industry, but most products and brands could find their place.

“Of course, there are products that make sense in esports and don’t in other sports, like keyboards,” Kutnowski said. “But those are very specific. But nowadays even insurance brands can be in esports. Insurance companies know that the kids playing games will be old enough to buy insurance. Even cars, with Lexus, Mercedes and others.”

According to Kutnowski, the main issue for the brands is the fact that the esports industry needs them to be authentic. Sports fans might enjoy the value that some partnerships bring, but if they do not enjoy them they just accept the fact that they “have to be there”, and move on. In esports, there is a demand for added value, and this demand is what makes it harder to stay relevant for some brands. It usually takes more effort to be a good partner for an esports organisation, compared to a large sports team.

The future

For 2023 onwards there are definitely a lot of question marks about what the next big trend will be, but, as Prousis said, one thing to follow is the ad rates in both sports and esports:

“ We have a real-time ad rates engine in Blinkfire, and it’s showing that from Q4 2021 to Q4 2022, ad rates started to drop on Facebook, Instagram, TikTok. It will be interesting to see this year how ad rates shift and how different industries, teams and esports organisations are using that.”

Lastly, Prousis noted that the esports industry still has a “grip” on the elusive Gen Z demographic, which is something traditional sports struggle with, and that is surely going to be one of the driving forces going forward.