This article was originally published in Esports Insider’s print magazine The Esports Journal Edition 12 on April 4th 2023. You can buy a print copy here or read the edition online for free here.

The complexity of the esports industry has increased in tandem with the growth of the market. This has made it essential for companies to professionalise quickly, and one of the most important aspects for any scaling business to address is its finances.

The more cash and investments flowing in and out of the esports industry, the more critical it is to process payments smoothly and efficiently. That’s why payment giants Nuvei and PayPal, in partnership with The Esports Journal’s sister publication Esports Insider, joined forces to survey the market and produce a whitepaper detailing the role of payments in esports and how these fundamental processes present opportunities for growth.

105 companies — including esports teams, tournament organisers, talent agencies, and other businesses related to esports — were surveyed on payment processes, revenue streams, and their thoughts about the future of the industry. The survey was conducted between June 21st and July 21st 2022 and involved selected entities from Europe, North America, Latin America, and Asia-Pacific.

Optimistic outlook

Over the last two years, the COVID-19 pandemic undoubtedly boosted viewership — and revenue — in the esports scene. As people stayed home, audiences increased for online services and entertainment in general — including esports content on platforms like Twitch and YouTube.

Esports relies mainly on online infrastructure and many of the leading competitions stayed active during the toughest parts of the pandemic.

That might explain why most of the interviewed esports companies believe that fans are not terribly concerned about COVID-19 impacting their travel plans and spending habits: 75% of companies indicated that they believe fans’ COVID concerns would not prevent them from returning to in-person events.

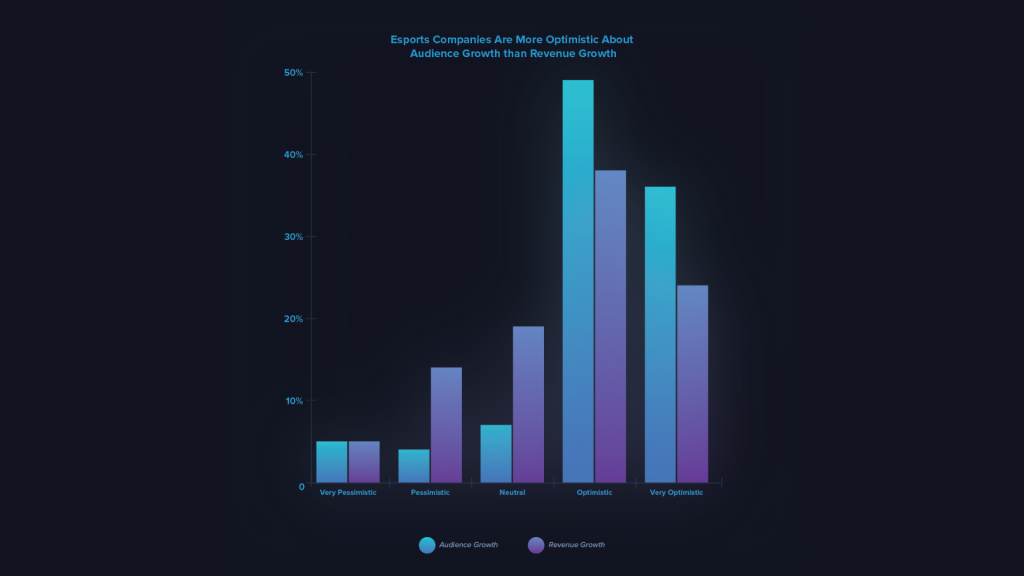

While still higher than pre-pandemic levels, companies are bracing for a drop-off in viewership as restrictions and infection rates in many parts of the world normalise. Yet the companies surveyed remain optimistic about the trajectory of esports viewership. In their opinion, esports will continue to grow: 85% of all respondents are optimistic about audience growth, while only 9% are pessimistic.

A developing scene

Esports companies are also optimistic when it comes to revenue: 62% believe earnings will

grow, while only 19% are pessimistic. While these companies are somewhat less

enthusiastic about revenue growth in comparison to audience growth, overall companies believe the future of the industry is full of potential.

Given the current state of the industry, this relative hesitancy around revenue projections is

justified: Of the 80% of companies that disclosed their financial performance for 2021, only

45% of these esports companies claimed to be profitable. This means that companies

believe in the long-term earnings potential of esports.

90% of the companies, though, agreed to report how their earnings changed in the last year.

Of those, 72% claimed their revenue grew in 2021, while only 10% said they earned less.

With nearly three of four businesses growing in the last year, there is a massive amount of

momentum propelling the industry forward.

To build on this upward trend, businesses must continue to be mindful of their strategic and

operational decisions at the foundation of their businesses.

Overcoming growth challenges

Esports companies are under tremendous pressure to become profitable. Companies are aggressively pursuing new revenue streams to become self-sufficient. With operations becoming increasingly complex, processing payments also becomes more involved.

Diversification and expansion also raise unprecedented challenges, and, for the sector’s potential to be fully explored, money needs to move around smoothly.

First, it is important to note that while sponsorships are still the dominant revenue stream, income sources in esports are going beyond sponsorship and merchandising more than ever before. Esports companies are monetising in a variety of ways.

Despite being a cutting-edge industry, esports companies still use relatively traditional methods when making and accepting payments. Nearly all of them accept and use some combination of invoices, direct bank transfers, and debit cards for their payment needs. Teams are more willing to be experimental, accepting 5 payment methods on average compared to 4 for event organisers.

This is a major missed opportunity for esports companies. Those that improve their business fundamentals in addition to growing revenue streams will be better positioned to grow than companies who remain passive about these core processes.

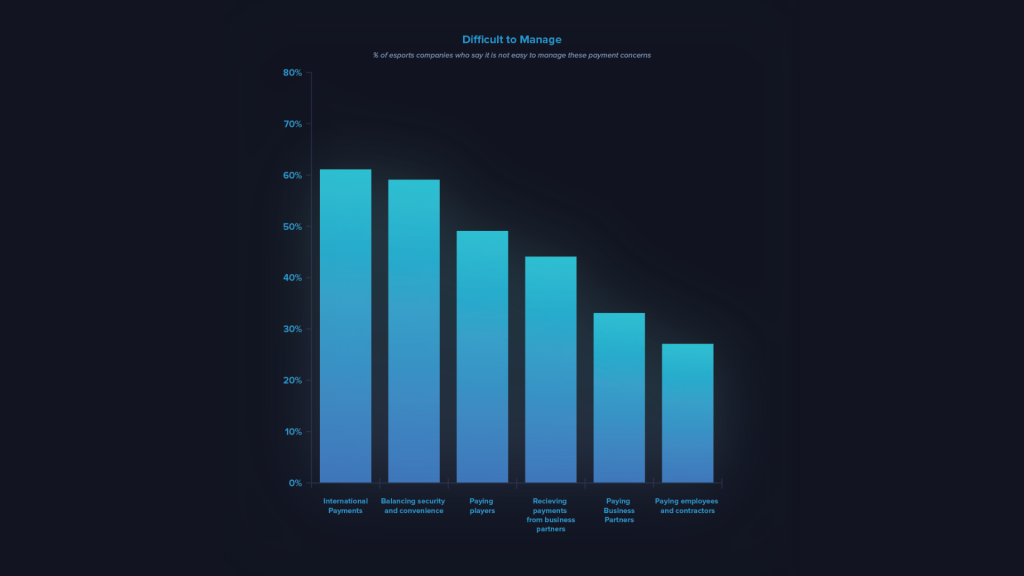

The main challenges affecting esports companies were also addressed by the survey. Results indicate that companies are aware of the services they need from payment partners, but might be limiting themselves to the same processes used by traditional industries.

International payments were considered to be the most difficult type of process. With esports being a predominantly digital, borderless sector, ideal payment partners for esports companies must be able to facilitate these transactions. Payment partners that operate in multiple countries, are knowledgeable about the regulations of different regions, and work with payments in local currencies will likely be very attractive to esports companies.

Esports companies also claim that being easy to use is a highly valued element for a payment partner. Companies in esports want a payment provider that doesn’t eat into their bandwidth. This means that a flexible, set-it-and-forget-it payment partner will be appreciated by scaling businesses in esports.

Solutions with easy API integrations and quick check-out processes will be highly valued in the esports sector, but, at the same time, the payment gateway must ensure that fraudulent transactions and chargebacks will be minimised. Partners that can balance security with convenience, as well as with reliable customer services, should be taken into consideration by esports companies.

Finding the right partners

Identifying these needs and understanding how to better support the esports sector delivered the rationale for this whitepaper’s research. Not only has esports grown in complexity, but payments have also become a concern to address in any globally expanding industry. Both Nuvei and PayPal believe that, by facilitating the payment process, they will be able to unlock the full potential for accelerating the growth of the whole scene.

Learn more about how esports companies view the future of the industry, their current revenue streams — including sponsorship preferences and their outlook on blockchain technology — and how payments can boost growth in the full Payments and the Monetization of Esports whitepaper, presented by Nuvei and PayPal. The report is available on the ESI Marketplace, which is accessible on esportsinsider.com.