Esports betting has become a prominent player in the esports industry, particularly across CS:GO and Dota 2. Together with League of Legends, these three titles are often dubbed ‘the big three’ within esports betting circles simply due to their popularity among customers.

That popularity has fueled significant growth over the last 10 years. Esports fans are getting older, and bookmakers are looking to target a younger demographic than traditional sports bettors.

This, among many other factors, has resulted in more opportunities for esports punters, a professionalised betting ecosystem, and marketing activations that see bookmakers connect with esports fandoms.

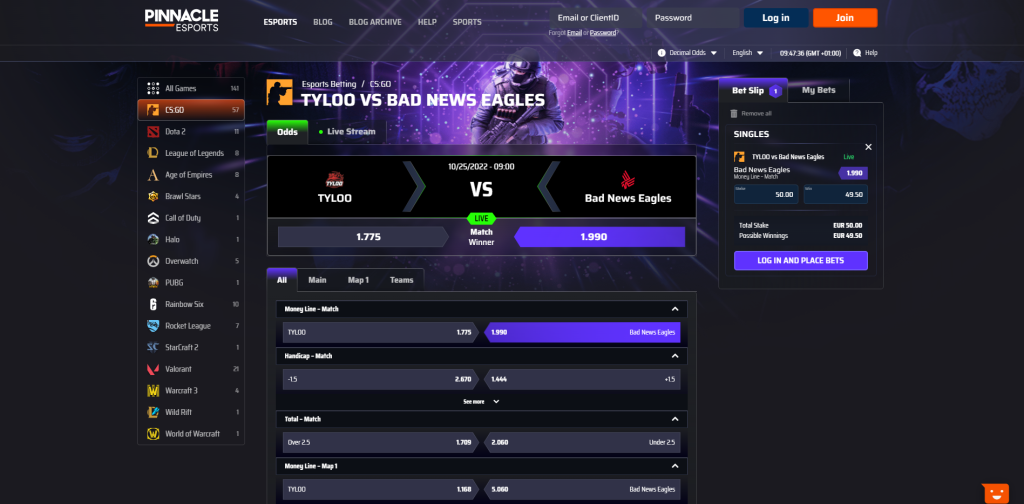

Esports Insider spoke to prominent personnel at online bookmaker Pinnacle to help map out esports betting’s 10-year journey — a tale of regulations, sponsorship and integration.

In February 2010, Pinnacle became the first bookmaker to post an esports betting market, enabling the first ever official bet to be placed on legacy esports title StarCraft 2.

As esports’ popularity increased, so did betting — especially as player and team fandoms emerged. By December 2014, Pinnacle had recorded over 1m esports bets taken. Pinnacle’s rise coincided with the emergence, and eventual shutdown, of a grey market of unregulated gambling using in-game items. That industry, touted to be worth as much as $7.4bn at its peak, both increased the popularity of esports betting and marred its reputation.

The growth of esports also caught the attention of other non-endemic bookmakers, such as Unibet, Bet365, William Hill and Dafabet.

The sponsorship surge

As bookies introduced their own esports betting options and tried to capture the valuable esports audience, the industry went through somewhat of a sponsorship boom. This period was headlined by sponsorships such as Fnatic’s 2015 deal with Dafabet. Moreover, some partnerships have since evolved even further by including naming rights, such as Digntas’ deal with VIE.GG.

In the following years, a range of bookmakers used this marketing tactic in order to help attract esports customers, with most also having their own dedicated esports offerings.

Alex McBride, Pinnacle’s Head of Esports, explained why sponsorships have become so integral to both bookmakers and esports entities throughout this period.

“What makes esports unique is that they [fans] follow their favourite teams and not necessarily their closest team like in football,” McBride reflected. “If we can align our brand with their team, create content that appeals to those needs and create cool activations that add value to the team by association, then we’re ticking the boxes when it comes to creating a favourable experience between those fans and what we set out to achieve.

“Esports teams are very open to new ideas and ways to connect with their audience. For those teams, it’s about creating engaging, fun and unique content that wouldn’t have been necessarily created without that sponsorship.”

Betting’s integration into esports was made possible due to laxer regulations from some game developers, such as Valve, that allow bookmakers to sponsor esports teams and major tournaments. Valve’s approach is a departure from the anti-gambling stance many other developers, most notably Riot Games, took — and still take — in their titles.

When asked whether the course of esports betting would have been different if publishers like Valve followed stricter regulations, McBride said: “No one can ever say in truth how different esports would be for betting operators, but we do know that it would have been a much slower rise to reach where it is today.”

According to McBride, Valve’s laissez-faire regulatory approach provided Pinnacle and other bookmakers with the opportunity to support and sponsor industry stakeholders, ranging from tier-one organisations to lower teams, casters and communities.

The openness of certain titles (and the closedness of others) has been a defining factor in the growth and inclusion of esports betting in competitive gaming’s story thus far. However, organisations have also had to face the difficult task of ensuring that only the correct players enter the game. Having properly regulated bookmakers and iGaming sites enter the scene is a prerequisite to esports taking betting seriously, and vice versa.

Regulation, integrity and more regulation

Following the initial sponsorship boom, which has since abated into a slow but steady trickle — albeit now largely overshadowed by the Web3 boom — another defining moment in esports betting’s history was a change in regulations. In 2018, the United States opened the door for betting regulation by repealing the Professional and Amateur Sports Provision Act 1992 (PASPA), which made it unlawful for a state to sponsor, operate, advertise, license or authorise sports betting. This change provided substantial opportunities for bookmakers — both in sports and esports.

“A significant revenue stream from esports betting is dependent on its take up in the US, and that’s largely reliant on how open lawmakers are to including it among established or upcoming regulation,” said Rohini Sardana, Pinnacle Solution’s Business Development Director.

“Regulators should now be able to see the commercial appeal of esports coupled with how the industry takes integrity seriously and how it rightly ranks in the top tier of betting sports. If the choice is to ignore esports betting or to go in a different direction, they’ll be losing out on shaping the future of the only real growing betting vertical at present.”

The esports industry’s stance and record on integrity, whilst not perfect, has played a factor in convincing policymakers to formally integrate it into existing or new legal frameworks. Integrity issues are overseen by the Esports Integrity Commission (ESIC), which promotes and facilitates integrity within the competitive ecosystem at all levels.

At the time of writing, ESIC has over 50 supporting partners ranging from bookmakers and data providers to government bodies and tournament operators. There is still a long way to go when it comes to bolstering integrity within esports, especially at the lower levels of play. However, the decision to tackle this issue early has provided credibility to endemic bookmakers and eased the worries of traditional igaming companies.

The pandemic boom

Perhaps one of the most defining factors in esports’ growth as a whole was the COVID-19 pandemic. With countless people locked down inside their houses and traditional sports halting its operations, gaming rose in popularity and esports became one of the only sports-like mediums available.

Suddenly there were more eyes on the esports product, sports simulation titles such as sim-racing rose in popularity, and bookmakers had to pivot their betting operations to provide more esports odds for customers.

According to the UK Gambling Commission, esports betting’s Gross Gambling Yield (the amount retained by gambling operators after the payment of winnings prior to operating cost deductions) for March 2019 in the country was roughly £50,000. In April 2020, it amounted to £4.62m.

Perhaps one of the most defining factors in esports’ growth as a whole was the COVID-19 pandemic. With countless people locked down inside their houses and traditional sports halting its operations, gaming rose in popularity and esports became one of the only sports-like mediums available.

Suddenly there were more eyes on the esports product, sports simulation titles such as sim-racing rose in popularity, and bookmakers had to pivot their betting operations to provide more esports odds for customers.

From sportsbook to esportsbook

In the present day, integrating a brand into esports is the goal of most marketing departments. Some of the most successful traditional bookmakers have established a recurring customer base within esports due to their popularity within certain titles.

“We’re far past the days of sticking a logo on a set of assets from a team or tournament and hoping that they’ll convert through to customers,” stated McBride.

Pinnacle became the first major bookmaker to deliver its own esports tournament franchise, including the first operator-led LAN event, as part of the Pinnacle Cup series. The series featured events in CS:GO and Dota 2. Instead of sponsoring someone else’s event, the bookmaker looked at its own data and customer demand and made its own. Topping out at 200,000 peak viewers and 2.6m hours watched, per Esports Charts, the event brought the brand directly to fans.

McBride continued: “[Pinnacle Cup] gave us a chance to connect with players and talk about the benefits of Pinnacle and actually show them we’re part of the scene, that we have been for years and that we’re on the same page as them.”

McBride highlighted that the key to the sector’s growth going forward is how well operators interact with the esports community, and whether that relationship strengthens or weakens over the next ten years. Pivotal developments, like the rise of mobile esports, offer new challenges and new opportunities for betting providers to do so. On the whole, McBride is positive about how esports betting is shaping up for the future. He said simply: “It’s going to be bigger.”

Supported by Pinnacle