As esports companies scale, they must make decisions with far reaching consequences. Data, especially audience insights, are crucial for making the right choices.

In our Payments and the Monetization of Esports whitepaper, in collaboration with Nuvei and PayPal, esports companies including teams, talent agencies and event organisers were surveyed about their outlook on the industry, payment methods and monetisation strategies.

Each company faces its own challenges, but there is overwhelming consensus that monetising the esports audience is a top priority. 65%* of respondents said audience monetisation is one of their top three priorities for the future.

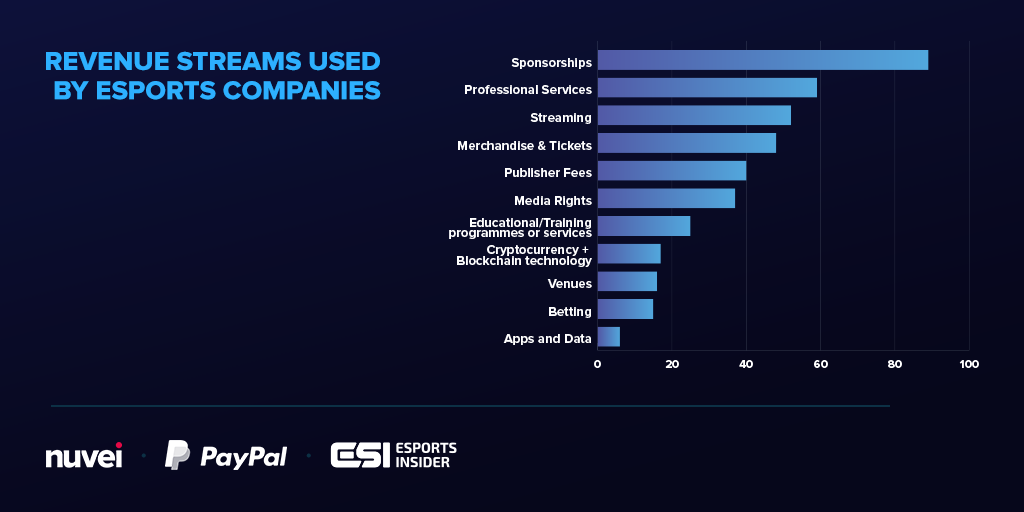

Rather than simply doubling down on traditional revenue streams like sponsorships and selling merchandise or tickets, esports companies are branching out and building new products and services to generate revenue.

While some are targeting B2B clients with professional services or publisher fees, many are looking to sell directly to fans.

46%* of surveyed companies are expanding their client facing operations — through some combination of betting, blockchain technology or cryptocurrency, educational or training programmes or services, or physical venues.

In order to develop these new consumer-facing revenue streams, esports companies must understand who they are building products for. Esports companies have almost universally (98%*) embraced audience data to better understand their customers.

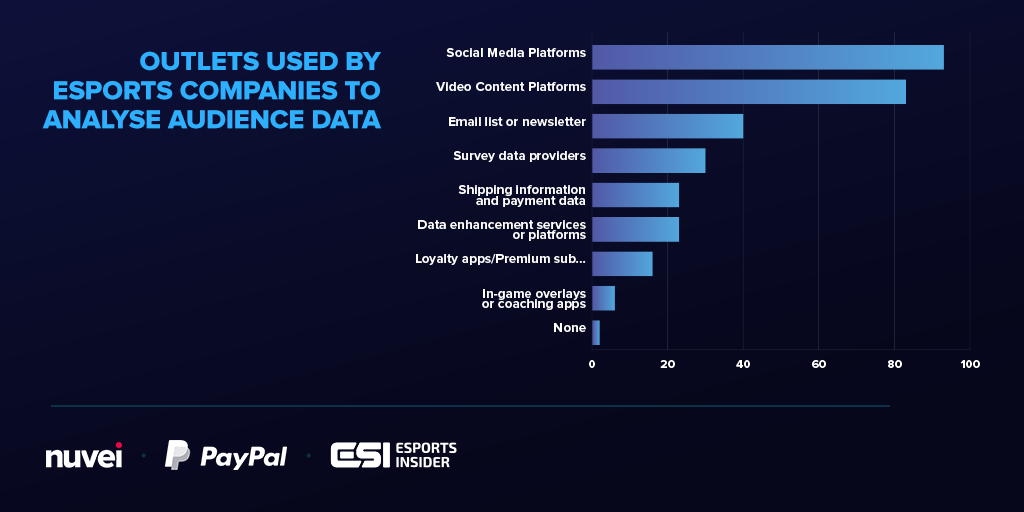

Like all digital businesses, social media plays a key role in esports. Sponsors often choose to partner with teams that will allow them to reach the greatest number of fans. Thus, it is critical for teams, talent agencies, and event organisers to build an audience on these platforms. However, social and video content platforms serve a secondary purpose for esports companies (and other digital businesses). They serve as a crucial tool for gathering data.

Social media platforms like Twitter, Discord, and Facebook are the most commonly used data sources for audience insights in esports. 93%* of esports companies surveyed are using at least one platform’s built-in tools to understand the followings they have built. Similarly, 83%* of respondents said they used social video content platforms — like Twitch, YouTube, TikTok, or Facebook Gaming — to understand their audience.

Social platforms are often the most accessible, and cheapest, option to learn more about a fandom. However, they do come with limitations. Often, these insights are high level and only draw from a user’s activity on the same platform. This is why nearly 1 in 4 (23%*) companies choose to also use platforms or services that enhance their existing audience data. For example, services like these can help companies connect audience behaviour across platforms or add additional insights about spending habits and the interests of their fans.

These data enhancement services provide even more value when esports companies are able to collect information about their fans directly. For example, esports companies can enhance data from their newsletter signups. 2 in 5 (40%*) esports businesses use their newsletters for this purpose. Similarly, about 1 in 4 (23%*) respondents said they use shipping and payment data for audience insights. The 48% of esport companies that sell merchandise or tickets have a major opportunity to collect data, putting them at a distinct advantage over companies that do not sell directly to consumers.

First-party data can often be difficult to collect so some companies in esports have chosen to invest their resources in tools to capture more of this information. Many companies — including both teams and event organisers — have built loyalty apps and subscriptions to both engage with and collect information on their most dedicated fans.

Approximately 1 in 6 (16%*) of the esports companies surveyed indicated that they use loyalty apps and subscriptions to collect information about their audience. If access to first-party data proves valuable to these early adopters, we may see more companies investing in similar programmes down the line.

Alternatively, esports companies may choose to partner with independent survey providers to handle this data collection or to add additional insights to their existing data set. Some of these survey companies are large international brands that research esports as a part of their wider offering. Other providers are more specialised, choosing instead to focus their work on gaming, esports and related topics. 30%* of respondents stated they had partnered with a survey company to collect information on their fans.

Finally, esports companies also collect audience data through another third party service, namely in-game overlays and coaching tools. These tools typically run in the background during a game, collecting data on both player performance and other information about the device being used. Only 6%* of respondents said they use this kind of data, but likely this figure was higher in the past before data privacy concerns became more prevalent.

As esports companies’ operations diversify, their data collection practices must follow suit. Measuring audience attitudes is essential to investing resources wisely. If esports companies do not build out their data infrastructure, they will fall behind the rest of the market.

To learn more about how esports companies are diversifying their operations outside of data collection and how payments can spark this growth, please check out the Payments and the Monetization of Esports whitepaper here.

*All statistics mentioned throughout this article have been taken from the Payments and the Monetization of Esports Whitepaper.

Supported by Nuvei and PayPal