We all thought we’d get to physical events this year. The idea, the hope, helped us hold it together after the break-the-mold-type-year that was 2020. And while the esports industry accepted the novel challenge of approaching last year’s difficulties one-handed — pivoting to online tournaments and events — the sector was ready to go back to what it was built for in 2021.

Esports did manage to sneak a few physical events past the keeper. Esports Insider rekindled its flagship ESI London event again after two years on ice. The Halo Championship Series Kickoff Major Raleigh 2021 debuted last week with hundreds in attendance. But, globally December has brought with it jingle bells, lockdowns, and a new-found global awareness of the 15th letter of the Greek alphabet: omicron.

To warm up the winter lockdown blues, we’re introducing Heat Map, a monthly feature serving up big-picture perspectives on the latest industry trends as observed by ESI, the go-to for esports business. Sign up for the accompanying newsletter and you’ll never be caught in the cold.

Desports — Esports, blockchain, and beyond

There’s always a new new that drops every quarter, promising to challenge the big dogs. That upcomer story, so popular with the youth, is reborn again and again. Less David vs Goliath, more “Started From The Bottom.” This upcomer narrative is endemic in esports- and crypto-communities alike, but for every moon shot, there’s a thousand duds. New crypto-coins, esports rosters, NFT projects, and tournament series are announced every day. The spaces seem to share a unique velocity to their fickleness, and in 2021 the two grew closer.

In 2021, venture capital firms poured $30 billion into the crypto industry, according to private & public market data company Pitchbook, cited in a recent report by Bloomberg. This might inform this year’s outright explosion of crypto partnerships in esports. ESI reported on over 25 esports cryptocurrency partnerships since January. Head over to ESI Staff Writer Ivan Šimić’s 2021 esports-focused investment review, Angels & Unicorns.

The industry’s current, and perhaps legacy, model relies on brand partnerships, and the marketing and advertising of crypto is still very tightly regulated across markets. Crypto companies seemingly have money to burn and a will to invest wherever it can spread its message (not dissimilar to the gambling sector, honestly). Esports has a highly-engaged, very online fan base – a sizable portion of which is already equipped with a crypto wallet. And everyone loves memes.

The biggest player in esports this year was Coinbase — which received 68 separate investments in 2021, according to its official Q3 blog, and boasts a portfolio of over 200+ companies and projects. The crypto juggernaut partnered with Team Liquid, BIG Esports, ESL Gaming, Evil Geniuses, BLAST Premier and BLAST Rising this year.

Bybit took an org-focused approach, inking with Astralis and Alliance, NAVI, and Virtus.pro. Additionally, FTX infamously partnered with TSM and later with the LCS, raising a few eyebrows given Riot’s barring of TSM’s name change on its esports broadcasts. Crypto.com partnered with Fnatic and Twitch Rivals and both Crypto.com and FTX paid eye-watering sums to affix their names to NBA stadiums.

Outside of big esports names, we received dozens of pitches in our inbox of shiny new orgs claiming to be built on the blockchain or operate exclusively with cryptocurrency. Do not get me started on the ‘metaverse’ pitches. I imagine next year, vapourware (not to be confused with vaporwave) will return to the modern lexicon, or a new TikTok-optimised term will emerge, I digress.

There are still quite a few notable orgs and TOs without a crypto link. This hesitancy could come from existing partnerships with financial institutions/payment providers or it could be that companies aren’t yet sold on jumping on the rocket. 100T continued its Cash App activation (which features Bitcoin integration), Dignitas signed with QNTMPAY, LOUD linked with Itau Bank, and LoL Esports staple Mastercard doubled down on the LEC.

The esports crowd was hella keen to engage with their fans and, well, monetise them, with this year’s NFT craze. We saw fan tokens, one-off drops, and plenty of platform partnerships. I, personally, am glad we didn’t see an esports generative art avatar project jumping-on-the-wagon. There were notable esports figures who drank the kool-aid and shelled out the $ETH for twitter clout, but to be fair, there’s much to be said about twitter clout’s role in the industry.

There were at least 15 NFT-focused partnerships as reported by ESI this year. Notable collaborations include: FaZe Clan shooting for the Moonpay (the crypto company closed $555m in November a la Bloomberg and this partnership was signed in December). Andbox tried to Moonwalk, G2 Esports inked with Bondly, Veloce found a partner and investor in Animoca Brands, and Talon Esports signed with Yieldly — the latter of which recently launched Yesports.gg, which has nothing to do with Kanye West, but is aiming to be an esports NFT marketplace/metaverse. Alexa, play “Yikes.”

TO’s didn’t want to miss out on all the fun. We saw WePlay Esports launch c0ll3ct1bl3s with Binance — back in my day, 1’s were L’s and 5’s were S’s, but whatever. ESL Gaming inked with Immutable X, and BLAST Premiere started minting chickens with Bondly. For other non-blockchain related partnerships in 2021, check out ESI Features Editor Jake Nordland’s The Dotted Line for a rundown of the year’s biggest partnerships.

Not everyone has been sold on ye olde blockchain of promise. Discord had its toe-in-the-water NFT moment before walking back a “probably nothing” tweet from CEO Jason Citron. Valve Corporation’s game client Steam hard-nope’d on the blockchain in October, reason being as cited in a Twitter thread by blockchain game developer Space Pirate: “Steam’s point of view is that items have value and they don’t allow items that can have real-world value on their platform.” This is why we can’t have nice immaterial things.

Hundred Thieves dropped a one-off Infinity NFT collection in tandem with its clothing line of the same name in April. Seemingly a flash in the pan as the org hasn’t minted anything since, likely to avoid the being called 100NFT in the comments. OG Esports amassed a whopping $1m from its three NFT drops, as reported by Dexerto in July.

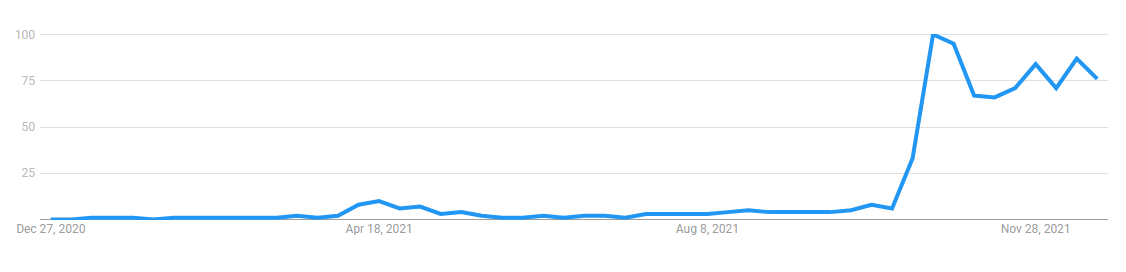

Nearing the year’s end, talk of metaverses and Web3.0 began dominating timelines. According to Google Trends, its interest peaked, predictably, in the days following Facebook’s name change. There was a 200% increase in metaverse pitches in our inboxes, complete with esoteric, amoebaos, and … liberal definitions of the word. It’s likely that the trend follows the Battle Royal path into 2022 — in all likelihood, the metaversal blue ocean of Q1 will be a bloodbath in Q4.

In an Esports Insider interview with Yieldly CEO Seb Quinn, it was hinted that unnamed esports orgs have already been spending months designing their metaverse presence under-the-radar. It’s promising to hear that at least a few esports orgs, having enlisted the best gamers on the planet, are adequately preparing themselves for battle.

Athletes go digital…again

Traditional sports athletes found a second wind in esports in 2021, with big names getting more involved than simply investing as we’ve seen in previous years. Manny Pacquiao announced Team Pacquiao GG in December. Manchester United showed a strong effort in esports this year. Jesse Lingard founded JLINGZ esports and David de Gea debuted Rebels Gaming. Harry Maguire joined Dominic Calvert-Lewin as brand ambassador for Semper Fortis Esports and Man U’s Manager Ole Gunnar Solskjær joined ownership of esports agency ULTI in April.

Not to be out-flexed by the world’s game, NFL athletes had a strong showing as well. Richard Sherman joined Enthusiast Gaming’s Board of Directors and quarterback Kyler Murray joined FaZe Clan. Marquez Valdes-Scantling launched Trench Made Gaming (TMG) in May, followed by Marco Wilson joining XSET in July. Kenny Vaccaro launched his own org in Gamers First (G1) just this month.

[primis_video widget=”5183″]Other notable entries include UFC fighter Marvin Vettori investing in QLASH in October. The NBA’s Jordan Clarkson and Jack McClinton joined skateboarding legend Tony Hawk to ink with Esports Technologies. The WNBA’s Ariel Powers joined Team Liquid in January and was recently invited into the company’s ownership.

Betting’s courtship was also alive and well in 2021. ESI Sub-editor Tom Daniels’s 2021 esports betting review, In Play, goes into details about those stories.

[maxbutton id=”11″ ]