Each month Esports Insider, in collaboration with Esports Charts, delves into esports viewership statistics to decipher what audiences are currently watching.

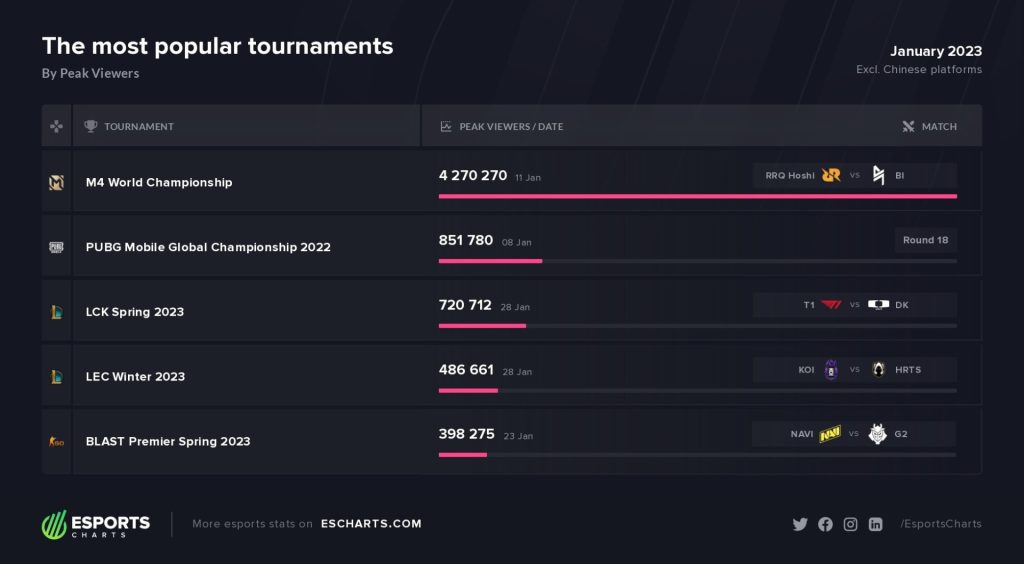

Despite it being a new year, it seems that from a viewership standpoint, it’s the same story as ever. Mobile esports is once again on top of the charts. However, with Asian goliaths Mobile Legends: Bang Bang and PUBG Mobile crowning world champions, that’s hardly a surprise. Still, January saw League of Legends and CS:GO kickstart their competitive seasons, both of which are featured in the top five.

BLAST Premier Spring 2023 fails to maintain momentum so far

Despite BLAST Premier Spring 2022 Finals becoming the tournament organiser’s second most popular event ever, this year’s Spring season has yet to match the popularity of last year.

Placing fifth on Esports Charts’ peak viewership list is BLAST Premier Spring 2023, securing a peak viewership figure of 398,275. It’s unfair to compare this figure to the 2022 Spring Finals’ (762,885), since this year’s finals haven’t happened yet. However, the peak viewership is still lower than BLAST Premier Spring 2022 group play, which peaked at 542,016.

Out of all of BLAST Premier Spring regular season events, the competition is the lowest since 2020, with both 2021 and 2022 securing over 500,000 peak viewers.

However, this year’s BLAST Premier figures are likely affected due to BLAST launching a new media platform in November 2022. According to an article by Dexerto, BLAST.TV viewership isn’t accounted for within Esports Charts’ data.

BLAST Premier Spring 2023’s highest viewed match-up was NAVI vs G2 Esports during day five of the Group Stage. In fact, NAVI and G2’s day eight clash was the tournament’s second most popular match-up as well. Further highlighting the importance of NAVI, the Ukrainian organisation is featured in all of the top five matches of BLAST Premier Spring 2022 and 2023.

LEC viewership drops despite promising format changes

Placing fourth on Esports Charts’ list is the inaugural LEC Winter Split, recording a peak viewership of 486,661 in January.

When comparing BO1 viewership between Winter 2023 and Spring 2022, the latter surpassed this year’s figure by over 50,000 with EXCEL and G2 Esports’ week one clash garnering 527,567. However, when looking further into the figures, there is a sense of optimism when it comes to LEC viewership, partly due to the tournament’s new format.

Alongside introducing an extra split and integrating the MENA region, the LEC’s new format has created a hybrid structure combining BO1’s, BO3’s and B05’s. In total, the LEC Winter Split only consists of three weeks of BO1 action, with two of the teams being eliminated at the end of that phase. Due to this, audiences have seemingly been retained throughout all three weeks.

Despite lower peak viewership, LEC Winter’s average viewership is currently higher than the entirety of LEC Spring 2022 (289,595 compared to 270,749). The true test for the new LEC format from a viewership perspective will be whether there will be a drop in viewers as the tournament enters its BO3 stage. In previous editions, the regular season typically has viewership drops until it reaches the Play-offs section.

One last point to mention is that following LEC’s decision to allow KOI and Team Heretics to co-stream in Spanish, viewership from the region has increased significantly. In fact, it’s the competition’s highest-ever Spanish-speaking viewership with a peak figure of 178,046. With this in mind, it’s not surprising to see LEC Winter 2023’s most popular match-up in January be KOI vs Team Heretics.

LCK Spring looks to beat its previous record

LCK’s week two battle between Korean powerhouses T1 and the newly named Dplus KIA secured 720,712 peak viewers, placing the tournament third on Esports Chart’s January list.

Similarly to the LEC, there is still a long way to go in the season. However, it could prove difficult to beat LCK Spring 2022, the competition’s highest-ever viewership (1.37m). In last year’s regular Spring season, T1’s clashes with Dplus KIA garnered 761,306 and 827,466 viewers.

So far this season, T1 dwarfs its LCK competitors with regards to both total hours watched and average viewership. In total, audiences have watched 7.4m hours of T1’s match-ups, with second and third being DPlus KIA and Hanwha Life Esports with 4.6m and 4.4m hours watched respectively.

The LCK has also managed to record impressive English-speaking viewership, with the Korean league securing a higher English peak viewership (219,228) than North America’s LCS (178,784).

PUBG Mobile continues its accession

Finishing second on Esports Charts’ list is the PUBG Mobile Global Championship 2022, garnering 851,780 peak viewers and becoming the sixth most popular PUBG Mobile event ever.

Despite BGMI (PUBG Mobile’s Indian variant) still being banned in the country, the tournament has seemingly managed to maintain a sizable audience ( India was previously one of the title’s most popular countries). The 2022 Global Championship event recorded a higher peak viewership than the PUBG Mobile Global Championship 2021 Finals (646,633).

Still, the mobile competition still has a long way to go if it wants to beat 2020’s PUBG Mobile Global Championship Season 0, which recorded over 3.8m viewers.

In terms of how PUBG Mobile’s Global Championship viewership was separated, Indonesian-speaking figures remained prominent, recording 241,402. This was followed by English-speaking (155,188) and Turkish (146,191) viewership.

M4 World Championship breaks Mobile Legends’ all-time viewership record

Topping the charts is Mobile Legends: Bang Bang’s M4 World Championship. The mobile esports event became the game’s most viewed esports event ever when it peaked at 4.2m concurrent viewers, as well as the third most popular esports event ever recorded. Only the 2022 League of Legends World Championship (5.1m) and the Free Fire World Series 2021 Singapore (5.4m) have recorded higher peak viewership figures.

Given that Esports Charts does not include Chinese viewership, given the difficulty of acquiring said data, MLBB’s impressive 4.2m figure highlights how popular the game is regardless, particularly within Southeast Asia. Perhaps the most surprising statistic is that Mobile Legends: Bang Bang’s M4 World Championships tops January’s English-speaking list with a figure of 477,136.

Across its 99-hour air time, the tournament amassed 80.1m hours watched, with its top five matchups all recording over 2.5m peak viewers. The most popular match-up was RRQ Hoshi’s playoff clash with Blacklist International, with RRQ appearing in the top five matches three times alongside Filipino organisation ECHO. For further viewership analysis of this series, check out Esports Insider’s article regarding the record-breaking figure.

What does February have to offer?

Perhaps one of the most intriguing developments will be whether the LEC continues to maintain momentum as the competition shifts from BO1 to BO3’s. Outside of League of Legends, all eyes will be on CS:GO’s IEM Katowice 2023 and whether it will be able to surpass last tournament’s impressive peak viewership of 1.1m.

Also taking place at IEM Katowice this month is ESL’s venture into sim-racing. ESL R1 sees 12 teams compete for a share of €500,000 (~£438,998) in prize money. With notable names such as G2 Esports, FaZe Clan, Heroic, BMW and Mercedes competing, viewership for the event could be incredibly interesting.